Hu and Mizuno (2020) Mathematica Appendix (5).nb

Author

Qing Hu, Tomomichi Mizuno

Title

Hu and Mizuno (2020) Mathematica Appendix (5).nb

Description

Supplemental notebook to "Endogenous timing and manufacturer advertising: A note"

Category

Academic Articles & Supplements

Keywords

endogenous timing, manufacturer, advertising, vertical market, retailer, pricing

URL

http://www.notebookarchive.org/2020-12-3qctlxw/

DOI

https://notebookarchive.org/2020-12-3qctlxw

Date Added

2020-12-08

Date Last Modified

2020-12-08

File Size

336.24 kilobytes

Supplements

Rights

Redistribution rights reserved

This file contains supplementary data for “Endogenous timing and manufacturer advertising: A note” by Qing Hu and Tomomichi Mizuno.

Endogenous timing and manufacturer advertising: A note

Mathematica Appendix

Endogenous timing and manufacturer advertising: A note

Mathematica Appendix

Mathematica Appendix

Qing and Tomomichi

Faculty of Economics, Kushiro Public University of Economics, Ashino 4-1-1, Kushiro-shi, Hokkaido, 085-8585, Japan. E-mail: huqing549@gmail.com

Graduate School of Economics, Kobe University, 2-1 Rokkodai, Nada, Kobe, Hyogo, 657-8501, Japan. E-mail: mizuno@econ.kobe-u.ac.jp

*

Hu

+

Mizuno

*

+

Clear["Global`*"]

2. Model

2. Model

We define each consumer’s demand as follows.

demand=q1-,q2-

a-p1-aγ+p2γ

b(-1+γ)

a-p2-aγ+p1γ

b(-1+γ)

q1-,q2-

a-p1-aγ+p2γ

b(-1+γ)

a-p2-aγ+p1γ

b(-1+γ)

Since θ consumers watching the advertising, demands for the retailers are

{θq1,θq2}/.demand;Demand={Q1%[[1]],Q2%[[2]]}

Q1-,Q2-

(a-p1-aγ+p2γ)θ

b(-1+γ)

(a-p2-aγ+p1γ)θ

b(-1+γ)

Consumer surplus is

CS=

(--+2(-1+γ)-2a(p1+p2)(-1+γ)+2p1p2γ)θ

2

p1

2

p2

2

a

2b(-1+γ)

(--+2(-1+γ)-2a(p1+p2)(-1+γ)+2p1p2γ)θ

2

p1

2

p2

2

a

2b(-1+γ)

The profits of retailers are

π1=(p1-w)Q1;π2=(p2-w)Q2;

The profit of manufacturer is

πM=(w-c)(Q1+Q2)-(kθ^2);

The producer and total surpluses are

PS=π1+π2+πM;TS=CS+PS;

3. Analysis

3. Analysis

Stage 4: simultaneous pricing

Stage 4: simultaneous pricing

First, we consider the case with simultaneous pricing.From the first-order condition, we obtain in (1).

B

p

{π1,π2};%/.Demand;Solve[{D[%[[1]],p1]0,D[%[[2]],p2]0},{p1,p2}]//Flatten;OutcomepB=%

p1-,p2-

a+w-aγ

-2+γ

a+w-aγ

-2+γ

Stage 4: sequential pricing

Stage 4: sequential pricing

Next, we consider the case with sequential pricing.From the first-order condition, we obtain the best response for the in (2):

F

p

L

p

π2;%/.Demand;Solve[D[%,p2]0,p2]//Flatten;OutcomepF=%;%/.{p1pL}

p2(a+w-aγ+pLγ)

1

2

Then, the leader chooses the price in (3):

L

p

π1;%/.Demand;%/.OutcomepF;Solve[D[%,p1]0,p1]//Flatten//Simplify;OutcomepL=%

p1

w(-2-γ+)+a(-2+γ+)

2

γ

2

γ

2(-2+)

2

γ

Stage 3

Stage 3

Proof of Lemma 1

Proof of Lemma 1

Under simultaneous pricing in the retail market, the manufacturer chooses the following wholesale price.

πM;%/.Demand;%/.OutcomepB;Solve[D[%,w]0,w]//Flatten//Simplify;Outcomew=%

w

a+c

2

Under sequential pricing, the manufacturer sets the following wholesale price.

πM;%/.Demand;%/.OutcomepF;%/.OutcomepL;Solve[D[%,w]0,w]//Flatten//Simplify

w

a+c

2

Hence, we obtain Lemma 1. Q.E.D.

Stage 2

Stage 2

Proof of Lemma 2

Proof of Lemma 2

Under simultaneous pricing in the retail market, the first-order condition leads to the advertising level in (4):

B

θ

πM;%/.Demand;%/.OutcomepB;%/.Outcomew;Solve[D[%,θ]0,θ]//Flatten//Factor;OutcomeθB=%θ/.%;θB=%

θ-

2

(a-c)

4bk(-2+γ)

-

2

(a-c)

4bk(-2+γ)

Similarly, for the sequential pricing case, the manufacturer chooses the advertising level in (5):

S

θ

πM;%/.Demand;%/.OutcomepF;%/.OutcomepL;%/.Outcomew;Solve[D[%,θ]0,θ]//Flatten//FullSimplify;OutcomeθS=%θ/.%;θS=%

θ(-8+(-1+γ)γ(4+γ))

2

(a-c)

32bk(-2+)

2

γ

2

(a-c)

32bk(-2+)

2

γ

Here, we compare with .

B

θ

S

θ

θB-θS//Factor

-(-1+γ)(2+γ)

2

(a-c)

2

γ

32bk(-2+γ)(-2+)

2

γ

Therefore, we obtain >. Q.E.D.

B

θ

S

θ

Here, we present the retailers’ profits in the case with simultaneous and sequential pricing as in (6) - (8).

Here, we present the retailers’ profits in the case with simultaneous and sequential pricing as in (6) - (8).

π1;%/.Demand;%/.OutcomepB;%/.Outcomew;%/.OutcomeθB//Simplify;πB=%

4

(a-c)

16k

2

b

3

(-2+γ)

{π1,π2};%/.Demand;%/.OutcomepF;%/.OutcomepL;%/.Outcomew;%/.OutcomeθS//FullSimplify;{πL,πF}=%

(-1+γ)(-8+(-1+γ)γ(4+γ)),-(-1+γ)(-8+(-1+γ)γ(4+γ))

4

(a-c)

2

(2+γ)

1024k

2

b

2

(-2+)

2

γ

4

(a-c)

2

(-4+(-2+γ)γ)

2048k

2

b

3

(-2+)

2

γ

In addition, we obtain the upstream profit and consumer, producer, and total surpluses under simultaneous pricing are as follows.

{πM,CS,PS,TS};%/.Demand;%/.OutcomepB;%/.Outcomew;%/.OutcomeθB//Simplify;{πMB,CSB,PSB,TSB}=%

,-,(-4+3γ),(-5+3γ)

4

(a-c)

16k

2

b

2

(-2+γ)

4

(a-c)

16k

2

b

3

(-2+γ)

4

(a-c)

16k

2

b

3

(-2+γ)

4

(a-c)

16k

2

b

3

(-2+γ)

Those under sequential pricing are as follows.

{πM,CS,PS,TS};%/.Demand;%/.OutcomepF;%/.OutcomepL;%/.Outcomew;%/.OutcomeθS//FullSimplify;{πMS,CSS,PSS,TSS}=%

,(-8+(-1+γ)γ(4+γ))(32+γ(32+γ(-16+γ(-20+γ+3)))),(-8+(-1+γ)γ(4+γ))(64+(-2+γ)γ(2+γ)(-4+γ(17+3γ))),(-8+(-1+γ)γ(4+γ))(160+γ(64+γ(-152+γ(-52+γ(35+9γ)))))

4

(a-c)

2

(-8+(-1+γ)γ(4+γ))

1024k

2

b

2

(-2+)

2

γ

4

(a-c)

2

γ

4096k

2

b

3

(-2+)

2

γ

4

(a-c)

2048k

2

b

3

(-2+)

2

γ

1

4096k

2

b

3

(-2+)

2

γ

4

(a-c)

Stage 1

Stage 1

Proof of Proposition 1

Proof of Proposition 1

We show the following profit ranking in (9).≤<if0.786≤γ<1,≤<if0.375≤γ<0.786,≤<if0<γ<0.375.First, we compare with .

B

π

L

π

F

π

L

π

B

π

F

π

L

π

F

π

B

π

F

π

L

π

πF-πL//Simplify

-(-1+γ)(4+3γ)(-8-4γ+3+)

4

(a-c)

3

γ

2

γ

3

γ

2048k

2

b

3

(-2+)

2

γ

Hence, we have >.

F

π

L

π

Next, we consider-.

Next, we consider

B

π

L

π

πB-πL//Simplify

-(-1+γ)(-32+16γ+48-8-18++)

4

(a-c)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

1024k

2

b

3

(-2+γ)

2

(-2+)

2

γ

The sign of - only depends on the term .Hence, the condition for ->0 is as follows.

B

π

L

π

--32+16γ+48-8-18++

2

γ

3

γ

4

γ

5

γ

6

γ

B

π

L

π

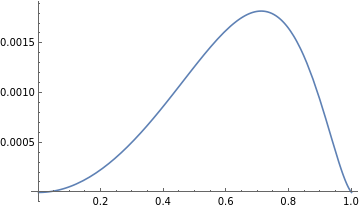

-(-32+16γ+48-8-18++);NSolve[%0,Reals]Plot[%%,{γ,0,1},AxesLabel{γ,"-"},LabelStyleDirective[15]]

2

γ

3

γ

4

γ

5

γ

6

γ

B

π

L

π

{{γ-4.24241},{γ0.785753},{γ1.5127},{γ3.57078}}

Then, ->0 if .

B

π

L

π

γ<0.786

Finally, we compare with .

Finally, we compare

B

π

F

π

πB-πF//Factor//Simplify

((-1+γ)(-128+320γ+192-352-64+112-2-7+))2048k

4

(a-c)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

2

b

3

(-2+γ)

3

(-2+)

2

γ

The sign of - only depends on the term .Hence, the condition for ->0 is as follows.

B

π

F

π

--128+320γ+192-352-64+112-2-7+

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

B

π

F

π

-(-128+320γ+192-352-64+112-2-7+);NSolve[%0,Reals]Plot[%%,{γ,0,1},AxesLabel{γ,"-"},LabelStyleDirective[15]]

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

B

π

F

π

{{γ-3.14907},{γ0.375032}}

Then, ->0 if .

Summarizing the above results, we obtain the profit ranking in (9).

From this profit ranking, we directly obtain Proposition 1. Q.E.D.

B

π

F

π

γ<0.375

Summarizing the above results, we obtain the profit ranking in (9).

From this profit ranking, we directly obtain Proposition 1. Q.E.D.

Here, we derive a probability in mixed strategy equilibrium.

Solving+(1-x)=+(1-x) for x, we obtain the following probability.

Here, we derive a probability

x

Solving

B

xπ

L

π

F

xπ

B

π

Solve[xπB+(1-x)πLxπF+(1-x)πB,x]//Flatten//Simplify

x

2(-2+)(-32+16γ+48-8-18++)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

256-384γ-448+416+232-132-38+9+

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

FInally, we compare the manufacturer’s profit and the various surplus measures under simultaneous and sequential pricing.

FInally, we compare the manufacturer’s profit and the various surplus measures under simultaneous and sequential pricing.

πMB-πMS//Factor//Simplify%b^2k/(a-c)^4;NSolve[%0,Reals]Plot[%%,{γ,0,1}]

-(-1+γ)(2+γ)(32-18++)

4

(a-c)

2

γ

2

γ

3

γ

4

γ

1024k

2

b

2

(-2+γ)

2

(-2+)

2

γ

{{γ-4.5904},{γ-2.},{γ-1.35127},{γ0.},{γ1.},{γ1.49815},{γ3.44352}}

CSB-CSS//Factor//Simplify%b^2k/(a-c)^4;NSolve[%0,Reals]Plot[%%,{γ,0,1}]

-(-1+γ)(768+384γ-896-384+360+108-58-5+3)

4

(a-c)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

4096k

2

b

3

(-2+γ)

3

(-2+)

2

γ

{{γ-3.63811},{γ-1.31121},{γ0.},{γ1.}}

PSB-PSS//Factor//Simplify%b^2k/(a-c)^4;NSolve[%0,Reals]Plot[%%,{γ,0,1}]

-(-1+γ)(768-384γ-1120+432+528-144-86+11+3)

4

(a-c)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

2048k

2

b

3

(-2+γ)

3

(-2+)

2

γ

{{γ-6.41887},{γ-2.41668},{γ0.},{γ1.},{γ1.02436},{γ3.79742}}

TSB-TSS//Factor//Simplify%b^2k/(a-c)^4;NSolve[%0,Reals]Plot[%%,{γ,0,1}]

-((-1+γ)(2304-384γ-3136+480+1416-180-230+17+9))4096k

4

(a-c)

2

γ

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

8

γ

2

b

3

(-2+γ)

3

(-2+)

2

γ

{{γ-5.11697},{γ-2.18668},{γ0.},{γ1.},{γ1.31809},{γ1.54455},{γ1.66468},{γ3.61843}}

Therefore, we find that upstream profit and consumer, producer, and total surpluses under simultaneous pricing are higher than those under sequential pricing.

4. Extensions

4. Extensions

4.1. Third-degree price discrimination in wholesale market

4.1. Third-degree price discrimination in wholesale market

Stage 4

Stage 4

First, we consider the case with simultaneous pricing.

In the fourth stage, the first-order condition leads to the following outcomes.

In the fourth stage, the first-order condition leads to the following outcomes.

{π1/.{ww1},π2/.{ww2}};%/.Demand;Solve[{D[%[[1]],p1]0,D[%[[2]],p2]0},{p1,p2}]//Flatten//Simplify;OutcomepBD=%

p1,p2

-2w1-w2γ+a(-2+γ+)

2

γ

-4+

2

γ

-2w2-w1γ+a(-2+γ+)

2

γ

-4+

2

γ

Next, we consider the case with sequential pricing.The follower chooses as follows.

FD

p

j

LD

p

i

π2/.{ww2};%/.Demand;Solve[D[%,p2]0,p2]//Flatten;OutcomepFD=%%/.p2,p1,w2wj

LD

p

j

LD

p

i

p2(a+w2-aγ+p1γ)

1

2

(a+wj-aγ+γ)

LD

p

j

1

2

LD

p

i

The leader sets as follows.

LD

p

i

π1/.{ww1};%/.Demand;%/.OutcomepFD;Solve[D[%,p1]0,p1]//Flatten//Simplify;OutcomepLD=%%/.{p1,w1wi,w2wj}

LD

p

i

p1

-w2γ+w1(-2+)+a(-2+γ+)

2

γ

2

γ

2(-2+)

2

γ

LD

p

i

-wjγ+wi(-2+)+a(-2+γ+)

2

γ

2

γ

2(-2+)

2

γ

Stage 3

Stage 3

Under simultaneous pricing, the manufacturer chooses wholesale prices as follows.

(w1-c)Q1+(w2-c)Q2-kθ^2;%/.Demand;%/.OutcomepBD;Solve[{D[%,w1]0,D[%,w2]0},{w1,w2}]//Flatten//Simplify

w1,w2

a+c

2

a+c

2

Under sequential pricing, the manufacturer sets the following wholesale prices.

(w1-c)Q1+(w2-c)Q2-kθ^2;%/.Demand;%/.OutcomepFD;%/.OutcomepLD;Solve[{D[%,w1]0,D[%,w2]0},{w1,w2}]//Flatten//Simplify

w1,w2

a+c

2

a+c

2

4.2. Timing of advertising

4.2. Timing of advertising

Case (i)

Case (i)

We define the following profits.

π1;%/.Demand;%/.OutcomepB//Simplify;πBT=%

-(-1+γ)θ

2

(a-w)

b

2

(-2+γ)

{π1,π2};%/.Demand;%/.OutcomepF;%/.OutcomepL//Simplify;{πLT,πFT}=%

(-1+γ)θ,-(-1+γ)θ

2

(a-w)

2

(2+γ)

8b(-2+)

2

γ

2

(a-w)

2

(-4-2γ+)

2

γ

16b

2

(-2+)

2

γ

We consider profit ranking.

πFT-πLT//Simplify

-(-1+γ)(4+3γ)θ

2

(a-w)

3

γ

16b

2

(-2+)

2

γ

Hence, we have >.

FT

π

LT

π

πLT-πBT//Simplify

2

(a-w)

4

γ

8b(-2+)

2

(-2+γ)

2

γ

Hence, we have >.

Therefore, we obtain<<.

LT

π

BT

π

Therefore, we obtain

BT

π

LT

π

FT

π

4.3. Persuasive advertising

4.3. Persuasive advertising

We define the following demand functions.

Demandpa=Q1-,Q2-

(a+θ)

b

p1-γp2

b(1-γ)

(a+θ)

b

p2-γp1

b(1-γ)

Q1-+,Q2-+

p1-p2γ

b(1-γ)

a+θ

b

p2-p1γ

b(1-γ)

a+θ

b

We define as follows.

SOC

z

zSOC=1/(2(2-γ))

1

2(2-γ)

Stage 4

Stage 4

Under simultaneous pricing, the first-order conditions yields as follows.

Bpa

p

{π1,π2};%/.Demandpa;Solve[{D[%[[1]],p1]0,D[%[[2]],p2]0},{p1,p2}]//Flatten//Simplify;OutcomepBpa=%%/.{p1,p2}

Bpa

p

Bpa

p

p1,p2

a+w-aγ+θ-γθ

2-γ

a+w-aγ+θ-γθ

2-γ

,

Bpa

p

a+w-aγ+θ-γθ

2-γ

Bpa

p

a+w-aγ+θ-γθ

2-γ

Under sequential pricing, the follower chooses as follows.

Fpa

p

Lpa

p

π2;%/.Demandpa;Solve[D[%,p2]0,p2]//Flatten//Simplify;OutcomepFpa=%%/.{p1,p2}

Lpa

p

Fpa

p

p2(a+w-aγ+p1γ+θ-γθ)

1

2

(a+w-aγ+γ+θ-γθ)

Fpa

p

1

2

Lpa

p

The leader sets as follows.

Lpa

p

π1;%/.Demandpa;%/.OutcomepFpa;Solve[D[%,p1]0,p1]//Flatten//Simplify;OutcomepLpa=%%/.{p1}

Lpa

p

p1

w(-2-γ+)+a(-2+γ+)+(-2+γ+)θ

2

γ

2

γ

2

γ

2(-2+)

2

γ

Lpa

p

w(-2-γ+)+a(-2+γ+)+(-2+γ+)θ

2

γ

2

γ

2

γ

2(-2+)

2

γ

Stage 3

Stage 3

Under simultaneous pricing, the manufacturer chooses the following wholesale price.

πM;%/.Demandpa;%/.OutcomepBpa;Solve[D[%,w]0,w]//Flatten//Simplify;Outcomewpa=%

w(a+c+θ)

1

2

Under sequential pricing, the manufacturer sets the following wholesale price.

πM;%/.Demandpa;%/.OutcomepFpa;%/.OutcomepLpa;Solve[D[%,w]0,w]//Flatten//Simplify

w(a+c+θ)

1

2

Stage 2

Stage 2

Under simultaneous pricing, the manufacturer chooses the advertising level as follows.

Bpa

θ

πM;%/.Demandpa;%/.OutcomepBpa;%/.Outcomewpa;Solve[D[%,θ]0,θ]//Flatten//Simplify;%/.{bz/k};OutcomeθBpa=%θBpa=θ/.%;%%/.{θ}

Bpa

θ

θ

-a+c

1+2z(-2+γ)

Bpa

θ

-a+c

1+2z(-2+γ)

Under sequential pricing, the manufacturer sets the advertising level as follows.

Spa

θ

πM;%/.Demandpa;%/.OutcomepFpa;%/.OutcomepLpa;%/.Outcomewpa;Solve[D[%,θ]0,θ]//Flatten//FullSimplify;%/.{bz/k};OutcomeθSpa=%θSpa=θ/.%;%%/.{θ}

Spa

θ

θ-

(a-c)(-8+(-1+γ)γ(4+γ))

-8+(-1+γ)γ(4+γ)-16z(-2+)

2

γ

-

Spa

θ

(a-c)(-8+(-1+γ)γ(4+γ))

-8+(-1+γ)γ(4+γ)-16z(-2+)

2

γ

Proof of Lemma 3

Proof of Lemma 3

We compare with .

Bpa

θ

Spa

θ

θBpa-θSpa//FullSimplifyReduce[%>0&&a>c>0&&0<γ<1&&z>zSOC]//Factor

-

2(a-c)z(-2+γ+)

2

γ

2

γ

(1+2z(-2+γ))(8-(-1+γ)γ(4+γ)+16z(-2+))

2

γ

0<γ<1&&z>-&&c>0&&a>c

1

2(-2+γ)

Therefore, we obtain >. Q.E.D.

Bpa

θ

Spa

θ

Substituting the subgame outcomes into the retailers’ profits, the profit of retailer with simultaneous pricing is:

Substituting the subgame outcomes into the retailers’ profits, the profit of retailer with simultaneous pricing is

Bpa

π

π1;%/.Demandpa;%/.OutcomepBpa;%/.Outcomewpa;%/.OutcomeθBpa//Simplify;%/.{z^2bξ/((a-c)^2(1-γ))}//Simplify;πBpa=%

ξ

2

(1+2z(-2+γ))

The profits of leader and follower with sequential pricing are and , respectively:

Lpa

π

Fpa

π

{π1,π2};%/.Demandpa;%/.OutcomepFpa;%/.OutcomepLpa;%/.Outcomewpa;%/.OutcomeθSpa//Simplify;%/.{z^2bξ/((a-c)^2(1-γ))}//FullSimplify;{πLpa,πFpa}=%

-,

8(-2+)ξ

2

(2+γ)

2

γ

2

(8-(-1+γ)γ(4+γ)+16z(-2+))

2

γ

4ξ

2

(-4+(-2+γ)γ)

2

(8-(-1+γ)γ(4+γ)+16z(-2+))

2

γ

Proof of Proposition 2

Proof of Proposition 2

Comparing , , and , we show the following profit ranking.

<< if <z<,

<< if <z<,

<< if <z<.

Bpa

π

Lpa

π

Fpa

π

Lpa

π

Fpa

π

Bpa

π

SOC

z

BF

z

Lpa

π

Bpa

π

Fpa

π

BF

z

BL

z

Bpa

π

Lpa

π

Fpa

π

BF

z

BL

z

First, we consider the sign of -.

Fpa

π

Lpa

π

πFpa-πLpa//FullSimplify

4(4+3γ)ξ

3

γ

2

(8-(-1+γ)γ(4+γ)+16z(-2+))

2

γ

Then, we obtain >.

Fpa

π

Lpa

π

Next, we consider the sign of-.

Next, we consider the sign of

Bpa

π

Lpa

π

πBpa-πLpa//Factor//Simplify

2

γ

2

γ

3

γ

4

γ

2

γ

2

z

2

γ

2

γ

2

(1+2z(-2+γ))

2

(-8-4γ+3+-16z(-2+))

2

γ

3

γ

2

γ

The sign of - only depends on the terms in the numerator: .Solving for , we obtain the threshold values (=zBLl) and (=zBLh) as follows.

Bpa

π

Lpa

π

-16-8γ+9+6+-32z-2++32-2+

2

γ

3

γ

4

γ

2

γ

2

z

2

γ

2

γ

-16-8γ+9+6+-32z-2++32-2+=0

2

γ

3

γ

4

γ

2

γ

2

z

2

γ

2

γ

z

BL

z

BL

z

Solve[-16-8γ+9+6+-32z(-2+)+32(-2+)0,z];Simplify[%,0<γ<1]z/.%;{zBLh,zBLl}=%

2

γ

3

γ

4

γ

2

γ

2

z

2

γ

2

γ

z,z-

-8+4+(-1+γ)

2

γ

2

(2+γ)

4-2

2

γ

8(-2+)

2

γ

2

γ

8-4+(-1+γ)

2

γ

2

(2+γ)

4-2

2

γ

8(-2+)

2

γ

2

γ

,-

-8+4+(-1+γ)

2

γ

2

(2+γ)

4-2

2

γ

8(-2+)

2

γ

2

γ

8-4+(-1+γ)

2

γ

2

(2+γ)

4-2

2

γ

8(-2+)

2

γ

2

γ

Comparing with , we have <.

BL

z

SOC

z

BL

z

SOC

z

zSOC-zBLl;NSolve[%0,Reals]Plot[%%,{γ,0,1},PlotRange{0,0.01},AxesLabel{γ,"-"},LabelStyleDirective[15]]

SOC

z

BL

z

{{γ1.}}

Next, we show <.

SOC

z

BL

z

zBLh-zSOC;NSolve[%0,Reals]Plot[%%,{γ,0,1},AxesLabel{γ,"-"},LabelStyleDirective[15]]

BL

z

SOC

z

{{γ1.}}

Hence, we obtain <<.

Summarizing the above results, we have

> if <z<,

≤ if .

BL

z

SOC

z

BL

z

Summarizing the above results, we have

Bpa

π

Lpa

π

SOC

z

BL

z

Bpa

π

Lpa

π

z≥

BL

z

FInally, we compare with .

FInally, we compare

Bpa

π

Fpa

π

πBpa-πFpa//Factor//FullSimplify

-(-1+(-1+4z)γ)(-16+4z(16+(-8+γ))+γ(-8+γ(5+γ)))ξ

2

γ

2

γ

2

(1+2z(-2+γ))

2

(8-(-1+γ)γ(4+γ)+16z(-2+))

2

γ

The sign of - only depends on the terms .Solving for , we obtain two threshold values: (=zBFl) and (=zBFh).

Bpa

π

Fpa

π

-(-1+(-1+4z)γ)-16+4z16+(-8+γ)+γ(-8+γ(5+γ))

2

γ

-(-1+(-1+4z)γ)-16+4z16+(-8+γ)+γ(-8+γ(5+γ))=0

2

γ

z

BF

z

BF

z

Solve[-(-1+(-1+4z)γ)(-16+4z(16+(-8+γ))+γ(-8+γ(5+γ)))0,z]z/.%;{zBFh,zBFl}=%

2

γ

z,z

1+γ

4γ

16+8γ-5-

2

γ

3

γ

4(16-8+)

2

γ

3

γ

,

1+γ

4γ

16+8γ-5-

2

γ

3

γ

4(16-8+)

2

γ

3

γ

Here, we show <<.

BF

z

SOC

z

BF

z

zSOC-zBFl//Simplify

2

γ

2

γ

4(-2+γ)(16-8+)

2

γ

3

γ

zBFh-zSOC//Simplify

-2+γ+

2

γ

4(-2+γ)γ

Hence, we omit the threshold value (=zBFl).

Summarizing the above discussion, we obtain the followings.

> if <z<,

≤ if .

BF

z

Summarizing the above discussion, we obtain the followings.

Bpa

π

Fpa

π

SOC

z

BF

z

Bpa

π

Fpa

π

z≥

BF

z

Before obtaining profit ranking, we confirm<.

Before obtaining profit ranking, we confirm

BF

z

BL

z

zBLh-zBFh//Factor//FullSimplifyNSolve[%0]Plot[%%,{γ,0,1}]

(-2+γ+)4+2

2

γ

4-2

+γ-2γ+2

γ

4-2

2

γ

8(-2+)

2

γ

2

γ

{{γ-2.},{γ1.}}

Summarizing all the cases, we obtain the following profit ranking.

<< if <z<,

<< if <z<,

<< if <z<.

Q.E.D.

Lpa

π

Fpa

π

Bpa

π

SOC

z

BF

z

Lpa

π

Bpa

π

Fpa

π

BF

z

BL

z

Bpa

π

Lpa

π

Fpa

π

BF

z

BL

z

Q.E.D.

4.4. Cournot competition between retailers

4.4. Cournot competition between retailers

We define the inverse demand functions.

IDemand=p1a-,p2a-

b(Q1+γQ2)

θ(1+γ)

b(Q2+γQ1)

θ(1+γ)

p1a-,p2a-

b(Q1+Q2γ)

(1+γ)θ

b(Q2+Q1γ)

(1+γ)θ

Stage 4

Stage 4

Under simultaneous competition, the first-order condition leads to the output as follows.

C

Q

{π1,π2};%/.IDemand;Solve[{D[%[[1]],Q1]0,D[%[[2]],Q2]0},{Q1,Q2}]//Flatten//Simplify;OutcomeQC=%

Q1,Q2

(a-w)(1+γ)θ

b(2+γ)

(a-w)(1+γ)θ

b(2+γ)

Next, under sequential competition, the follower chooses .

FC

Q

LC

Q

π2;%/.IDemand;Solve[D[%,Q2]0,Q2]//Flatten//Simplify;OutcomeQFC=%%/.{Q1,Q2}

LC

Q

FC

Q

Q2

-bQ1γ+(a-w)(1+γ)θ

2b

FC

Q

-bγ+(a-w)(1+γ)θ

LC

Q

2b

The leader sets the following output .

LC

Q

π1;%/.IDemand;%/.OutcomeQFC;Solve[D[%,Q1]0,Q1]//Flatten//Simplify;OutcomeQLC=%%/.{Q1}

LC

Q

Q1

(a-w)(-2+γ)(1+γ)θ

2b(-2+)

2

γ

LC

Q

(a-w)(-2+γ)(1+γ)θ

2b(-2+)

2

γ

Stage 3

Stage 3

With simultaneous competition, the manufacturer chooses the following wholesale price.

πM;%/.IDemand;%/.OutcomeQC;Solve[D[%,w]0,w]//Flatten//Simplify;OutcomewC=%

w

a+c

2

Similarly, under the sequential competition, the manufacturer sets the wholesale price as follows.

πM;%/.IDemand;%/.OutcomeQFC;%/.OutcomeQLC;Solve[D[%,w]0,w]//Flatten//Simplify

w

a+c

2

Stage 2

Stage 2

Under simultaneous competition, the manufacturer chooses the level of advertising .

C

θ

πM;%/.IDemand;%/.OutcomeQC;%/.OutcomewC;Solve[D[%,θ]0,θ]//Flatten//Simplify;OutcomeθC=%%/.{θ}θC=θ/.%%

C

θ

θ(1+γ)

2

(a-c)

4bk(2+γ)

(1+γ)

C

θ

2

(a-c)

4bk(2+γ)

2

(a-c)

4bk(2+γ)

Under sequential competition, the manufacturer sets as follows.

SC

θ

πM;%/.IDemand;%/.OutcomeQFC;%/.OutcomeQLC;%/.OutcomewC;Solve[D[%,θ]0,θ]//Flatten//FullSimplify;OutcomeθSC=%%/.{θ}θSC=θ/.%%

SC

θ

θ(1+γ)(-8+γ(4+γ))

2

(a-c)

32bk(-2+)

2

γ

(1+γ)(-8+γ(4+γ))

SC

θ

2

(a-c)

32bk(-2+)

2

γ

2

(a-c)

32bk(-2+)

2

γ

Proof of Lemma 4

Proof of Lemma 4

We compare with .

SC

θ

C

θ

θSC-θC//Simplify

2

(a-c)

2

γ

32bk(2+γ)(-2+)

2

γ

Hence, we obtain >. Q.E.D.

SC

θ

C

θ

Stage 1

Stage 1

The profit of retailer with simultaneous competition is :

C

π

π1;%/.IDemand;%/.OutcomeQC;%/.OutcomewC;%/.OutcomeθC//Simplify;πC=%

4

(a-c)

2

(1+γ)

16k

2

b

3

(2+γ)

The profits of leader and follower with sequential competition are and , respectively.

LC

π

FC

π

{π1,π2};%/.IDemand;%/.OutcomeQFC;%/.OutcomeQLC;%/.OutcomewC;%/.OutcomeθSC//FullSimplify;{πLC,πFC}=%

-(-8+γ(4+γ)),(-8+γ(4+γ))

4

(a-c)

2

(-2+γ)

2

(1+γ)

1024k

2

b

2

(-2+)

2

γ

4

(a-c)

2

(1+γ)

2

(-4+γ(2+γ))

2048k

2

b

3

(-2+)

2

γ

Proof of Proposition 3

Proof of Proposition 3

In order to obtain Proposition 3, we show the following profit ranking.

<< if ,

≤< if .

C

π

FC

π

LC

π

γ<0.396

FC

π

C

π

LC

π

γ≥0.396

First, we compare with .

LC

π

C

π

πLC-πC//Simplify

-(-32+16γ-8+6+)

4

(a-c)

2

γ

2

(1+γ)

3

γ

4

γ

5

γ

1024k

2

b

3

(2+γ)

2

(-2+)

2

γ

Hence, we have >.

LC

π

C

π

Next, we consider-.

Next, we consider

C

π

FC

π

πC-πFC//Factor//Simplify

-(-128+320γ+128-288-64+64+14+)

4

(a-c)

2

γ

2

(1+γ)

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

2048k

2

b

3

(2+γ)

3

(-2+)

2

γ

The sign of - only depends on the terms .Solving for , we have

C

π

FC

π

-128+320γ+128-288-64+64+14+

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

-128+320γ+128-288-64+64+14+<0

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

γ

-128+320γ+128-288-64+64+14+;NSolve[%0,Reals]Plot[%%,{γ,0,1}]

2

γ

3

γ

4

γ

5

γ

6

γ

7

γ

{{γ0.395954},{γ1.30249},{γ1.46532}}

Hence, we obtain -<0 if ; -≥0 otherwise.

C

π

FC

π

γ<0.396

C

π

FC

π

Finally, we compare with .

Finally, we compare

FC

π

LC

π

πLC-πFC//FullSimplify

-(-4+3γ)(-8+γ(4+γ))

4

(a-c)

3

γ

2

(1+γ)

2048k

2

b

3

(-2+)

2

γ

Hence, we obtain >.

Summarizing the above results, we obtain the following profit ranking.

<< if ,

≤< if .

Therefore, we obtain Proposition 3. Q.E.D.

LC

π

FC

π

Summarizing the above results, we obtain the following profit ranking.

C

π

FC

π

LC

π

γ<0.396

FC

π

C

π

LC

π

γ≥0.396

Therefore, we obtain Proposition 3. Q.E.D.

Cite this as: Qing Hu, Tomomichi Mizuno, "Hu and Mizuno (2020) Mathematica Appendix (5).nb" from the Notebook Archive (2020), https://notebookarchive.org/2020-12-3qctlxw

Download